The following blog is by Carl Richards originally published in The New York Times’ Blog.

Humans can be a competitive lot. The way we posture and position ourselves to stand out in a group seems to happen instinctively. After all, in the past we competed for resources and survival. Our lives depended on it. Today, we still compete, but for different reasons.

Instead of food, we compete for attention and social currency. To figure out if we’re “winning,” we use visual shortcuts, and money offers one of the easiest ones. We look around and compare how we’re doing with what we see.

But there are a few problems with this approach. We don’t have access to our neighbors’ balance sheets, so we’re relying on the consumption we see, not true net worth. So we only think we know how they’re doing, and what we think we know can get us in trouble.

Imagine you come home one night and take a walk around the neighborhood. During your walk, a neighbor pulls up in a new Porsche Panamera Turbo. (The sticker price on that model starts at somewhere around $140,000, and I know you just looked it up.) You chat for a few minutes, and he tells you how much he loves driving the car.

Pause for just a second. I want you to make a mental note. What did you think about your neighbor and his car as you walked away?

I’m betting your thoughts jumped to something like, “He must make a lot of money,” or “How can he afford that car?” You made a judgment. You told yourself a story based on what you’d seen (a new car) and what you’d heard (I love driving the car).

See the problem? This story relies on one fact. You know your neighbor loves driving the new car, but the rest of your story qualifies as a fairy tale.

Let’s add a few wrinkles to this story:

■ What if he took out a home equity line of credit to cover 100 percent of the car’s price?

■ What if he recently sold his business for $1 billion and, as a percentage of his net worth, the new car is a drop in the bucket compared to yours?

■ What if he got a new job at the Porsche dealership, and he gets to drive the car as a demo for a few days?

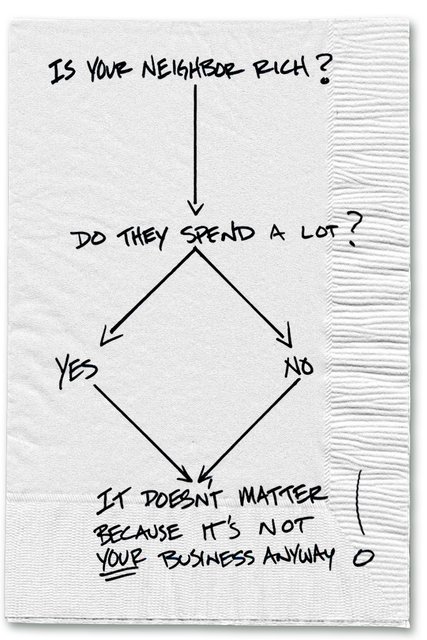

Your story changes if any of these facts proves true. Your neighbor may be rich. He could be leveraged to the hilt. You just don’t know. So what’s the point of comparing and feeling competitive without knowing the whole story?

I’ve been thinking a lot about this subject recently after a friend recommended Byron Katie’s work. I love the clarity she provides with the idea that there are only three kinds of business in the universe: my business, your business and God’s business.

■ Whose business is it if your neighbor has a Porsche Panamera Turbo in the driveway? Your neighbor’s.

■ Whose business is it if you feel badly because your neighbor “must make a lot of money” to drive a Porsche? Your business.

I know we like to compete. But we’ll always lose if we’re judging ourselves based on stories that rely solely on someone’s demonstrated consumer behavior. Luckily, we don’t need an outside force to solve the problem. We just need to stop competing and realize that our neighbor’s business isn’t our business anyway.

Meddling in our neighbor’s business rarely leads to good outcomes anyway. That leaves our own business. Plus, staying focused on our business comes with a side benefit. We no longer need to worry about our ranking or anyone else’s in this grand, social competition we call life … because we realize it’s none of our business.

About the author: For the last 15 years, Carl Richards has been writing and drawing about the relationship between emotion and money to help make investing easier for the average investor. His first book, “Behavior Gap: Simple Ways to Stop Doing Dumb Things With Money,” was published by Penguin/Portfolio in January 2012. Carl is the director of investor education at BAM Advisor Services. His sketches can be found at behaviorgap.com, and he also contributes to the New York Times Bucks Blog and Morningstar Advisor. You can now buy – “The Behavior Gap” by Carl Richard’s at AMAZON.

Thanks for sharing – such an on point piece!

Thanks for sharing – such an on point piece!