The following blog is by Carl Richards originally published in The New York Times’ Blog.

A friend of mine never understood why his neighbors spent a lot of money on things he didn’t care about, like houses and cars. To him, these things weren’t worth the money. So one time when he was being particularly grumpy about it, I asked him about his family’s spending habits.

I had noticed that compared with most families I knew, his family appeared to spend a lot of money on vacations and even more on recreational gear. My friend, being a smart guy, took only a moment to see the disconnect. Both my friend and his neighbors had made a decision that it was worth it to them to spend more on things and experiences that they really valued.

It’s not unusual to spend more money on the things that really matter to us. We probably all have something we refuse to substitute for a cheaper option. However, when we do spend more without building a framework for making these decisions, it’s the kind of behavior that can blow up budgets and lead us to spend more on things that aren’t worth the extra money.

Here are a few things to keep in mind.

1. It makes sense to spend more if we want something to last longer.

A few years ago, I had my eye on a new road bike. The bike I wanted wasn’t cheap, and I debated buying a less expensive option. But when I started weighing the purchase in terms of wanting to ride the bike for years, the more expensive, better-built bike made more sense. I still have and love the bike.

Time matters when we’re debating spending more. When we anticipate using something over a longer period of time, it’s important to compare the cost of replacing a cheaper version two or three times. If the cost is comparable, the more expensive option could be the better choice.

2. It makes sense to spend more if we want rare, specific experiences.

I imagine more than a few of you rolled your eyes when I shared my love of expensive ice cream. Part of the reason I enjoy it so much is the anticipation. I don’t eat it often, only once every few weeks. However, the pleasure I get from anticipating that next pint is almost worth the price alone. I wouldn’t feel the same way if it wasn’t a rare experience.

So when you want to spend more on something specific, remember to consider the value of anticipation and how often you plan on doing it. The rarer the event, the greater the anticipation, and research shows that anticipating a future event (like a vacation) can match or even beat the happiness of the event itself. It’s the rare two-for-one deal that makes it worth spending more if we’ve made the smart decision to save and plan for it.

3. It doesn’t make sense to spend more if it’s not a priority.

Sometimes the generic is just as good as the brand. Unlike my ice cream, I rarely opt for the most expensive laundry soap. Now, some of you may be really particular about your laundry soap. The point is when we spend more, we need to consider both reasons 1 and 2 and if it’s a purchase that actually matters to us.

If the options are interchangeable, then go for a less expensive choice. Don’t get in the habit of spending more for the sake of spending more.

4. It doesn’t make sense to spend more if it’s about competing with people.

My friend didn’t care about his neighbors’ cars and houses. For him, spending more on vacations and gear he really wanted was what mattered. So don’t forget the phrase “keeping up with the Joneses” when deciding what something is really worth.

Commit to spending more only on the things and experiences that matter personally. It doesn’t matter what our neighbors or friends want. Focus on what matters to you and your family and ignore what everyone else is doing.

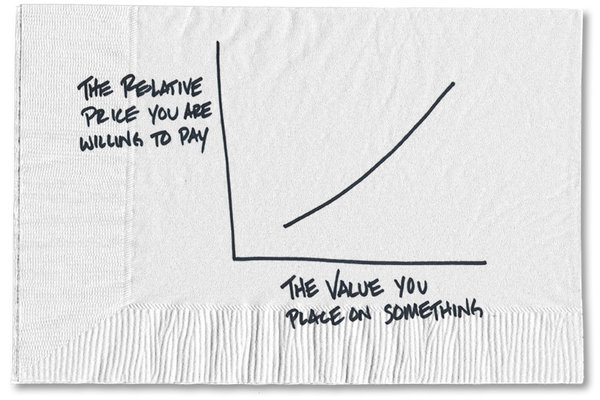

Spending a lot of money on something — even something we’d consider a luxury — doesn’t mean we’re making a bad money decision. It may even be the best decision. But to reach the point of knowing it’s a good decision, we need to be really aware of why we want to spend more and do our best to align the decision with our values.

The more we can make money decisions that support our values, the less likely we are to regret those decisions, even if they’re expensive choices. Keep that thought in mind the next time you wonder if it’s really worth it to spend more. Brace yourself: sometimes the answer will be yes.

About the author: For the last 15 years, Carl Richards has been writing and drawing about the relationship between emotion and money to help make investing easier for the average investor. His first book, “Behavior Gap: Simple Ways to Stop Doing Dumb Things With Money,” was published by Penguin/Portfolio in January 2012. Carl is the director of investor education at BAM Advisor Services. His sketches can be found at behaviorgap.com, and he also contributes to the New York Times Bucks Blog and Morningstar Advisor. You can now buy – “The Behavior Gap” by Carl Richard’s at AMAZON.

0 Comments