The following blog is by Carl Richards originally published in The New York Times’ Blog.

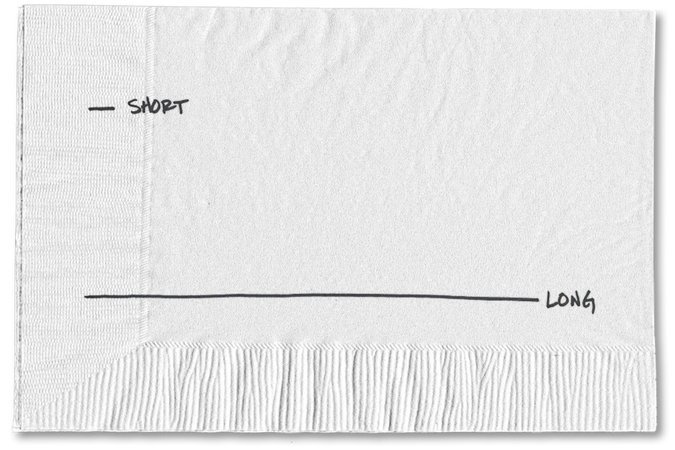

When I ask you to think long term, what comes to mind? Ten years from now? One year? One week? In a world where excellence is now measured in milliseconds, it can be incredibly difficult to think past the moment that’s right in front of us.

Winning and losing, on the trading floor or on the speedskating oval, happens in the blink of an eye. Instead of waiting weeks for a letter, we hit send and get text messages in seconds. Everything about our lives and this world seems really compressed, so it becomes easy to default to expecting instant answers and clear results.

Living this way may feel normal for most of us, but it’s not the only way to look at the world. For a different view, I decided to check in with friends of mine who are third-generation Idaho potato farmers.

When I asked them what it means to think long term, we started talking about sustainability, which makes sense since they’ve managed to stay in business for 60 years. It turns out that what may seem like a great decision for them right now could be unsustainable in five or even 10 years and could easily undermine the prior 20 years of work.

Whenever possible, their decisions get put in the context of whether they benefit the long-term health of the farm or require too much risk. While they have to make day-to-day decisions to keep things running, they can’t afford to only think about this year’s crop.

Let’s say my friends grew only potatoes each year. It wouldn’t take long before the ground was used up, and the crop quality took a nose-dive. Then they’d be left with nothing to farm and a bunch of equipment that isn’t needed.

Instead, they set up a rotation. One year, a field gets planted with potatoes. The next two years, it gets planted with grain. But this strategy only works because they plan out exactly what they’re going to do with all their ground, and it stretches out years into the future.

Sure, the pieces on the board may get moved around at times, but when you’re signing a 20-year lease for land, short-term thinking won’t get you very far. Farming demands long-term thinking.

So if we’re interested in shifting some of our decision making from short term to long term, what lessons can we learn from potato farmers?

1. Force yourself to think past next year.

Long-term thinking doesn’t come naturally, particularly in our current culture. We know that things change, but how does our perspective change when we think in terms of 10, 20 or even 30 years? It’s that kind of thinking that will keep my friends farming for 60 more years.

My family went through this process recently when we bought a new car. Our buying decision came down to figuring out what kind of car we could see ourselves driving for 10 years (including a few children who might end up driving it even when the adults aren’t using it anymore). Yes, it can feel sort of overwhelming to think that far into the future, but test it and see how it affects your decisions. It took a huge weight off to know that we could go 10 years without needing to make this particular choice again.

2. Spend only what you can sustain.

Until I had this farming conversation, I didn’t realize how expensive it is to buy farm equipment. A new potato harvester goes for well over $100,000, and that doesn’t include the cost of the tractor to pull it. Farmers would go broke if they bought all new equipment every year. So buying decisions are carefully weighed, and equipment gets bought only when the farm’s long-term sustainability won’t be hurt by the purchase.

What would happen if we adopted that attitude with our money decisions? Instead of buying everything that catches our eye, we could focus instead on buying things that last and fulfill a specific purpose. We can also ask questions like, “Will we have to cut back somewhere else to afford this purchase?” In the process, we’ll discover what it’s really costing us to spend without thinking long term.

3. Protect your resources.

It’s impossible to grow potatoes without water. So in addition to being farmers, my friends are also involved in helping manage water. From recharging aquifers to untangling outdated state laws, they’re engaged in protecting this incredibly valuable resource. It’s one of those pesky jobs that will never be done, but if there’s no water, there are no potatoes. Protecting the resource increases the odds that they’ll be able to grow potatoes for another 60 years.

The same holds true for us non-farmers. One thing that pops up often for me is the resource of time. It matters a lot that I have time to spend with my family. But if, for example, I end up spending a bunch of time on Twitter, I may very well be sacrificing family time for tweeting time. If we say we value something, we can’t pretend it’s a short-term thing. We need to protect it. Otherwise, we could run out of what we say matters most to us.

Obviously farming isn’t for everyone, but as I learned, farmers have long-term thinking down to a science. And as their experience suggests, it’s the long-term thinking that determines much of their success. I suspect the same could hold true for the rest of us.

About the author: For the last 15 years, Carl Richards has been writing and drawing about the relationship between emotion and money to help make investing easier for the average investor. His first book, “Behavior Gap: Simple Ways to Stop Doing Dumb Things With Money,” was published by Penguin/Portfolio in January 2012. Carl is the director of investor education at BAM Advisor Services. His sketches can be found at behaviorgap.com, and he also contributes to the New York Times Bucks Blog and Morningstar Advisor. You can now buy – “The Behavior Gap” by Carl Richard’s at AMAZON.

0 Comments